Debunking Myths: What You Should Know Before Buying a High-Performance ASIC Miner

In the ever-evolving world of cryptocurrency, the allure of mining—a process that validates transactions and secures blockchain networks—continues to captivate enthusiasts and investors alike. Among the myriad tools at a miner’s disposal, the high-performance ASIC miner stands out, promising efficiency and power beyond conventional devices. Yet, before plunging into the acquisition of these sophisticated machines, it’s crucial to sift through the myths and understand what truly matters. From Bitcoin and Ethereum to emerging coins like Dogecoin, the landscape is rich with nuances that impact your mining prospects.

ASIC miners—Application-Specific Integrated Circuits—are designed with a singular purpose: to execute cryptocurrency mining algorithms with unparalleled speed and efficiency. Unlike GPUs, which juggle a variety of tasks, ASICs focus on optimized hash computations. This specialization makes them particularly vital in mining Bitcoin (BTC), where the computational difficulty has escalated dramatically over the years. However, despite their clear edge, misconceptions about ASIC miners abound, especially regarding their profitability and flexibility.

One widespread myth posits that owning the most powerful ASIC miner guarantees guaranteed profits. While raw hashing power does enhance chances of mining rewards, profitability hinges on a constellation of factors: electricity costs, mining difficulty, coin market value, and the overall health of the blockchain network. For example, a miner might invest heavily in a top-tier Bitcoin ASIC but encounter slim returns if electricity prices soar or BTC prices dip. Moreover, ASICs often lack versatility; many are designed to mine a single algorithm, rendering them ineffective for coins like Ethereum (ETH) which utilize different mining protocols—prompting some to opt for GPUs or hybrid setups in certain cases.

Mining hosting emerges as a pivotal option for those seeking to circumvent the logistical labyrinth of running a rig at home. Hosting providers offer professional facilities equipped with climate control, robust internet connections, and optimized electrical infrastructure. This paradigm shift democratizes mining, allowing individuals without technical prowess or space constraints to participate. It’s essential, however, to vet hosting services carefully—security, uptime guarantees, and fee structures can significantly influence net yields. Notably, hosting is a boon for miners working with Bitcoin and Dogecoin (DOG), both of which demand consistent uptime to stay competitive.

An intriguing facet within this ecosystem is the dynamic between different cryptocurrencies and their respective mining hardware. Bitcoin reigns supreme with its SHA-256 algorithm, catered to by specialized ASICs. Dogecoin, once perceived as a lighthearted token, shares this algorithmic foundation, allowing miners to simultaneously earn from merged mining strategies. In contrast, Ethereum’s transition to Proof of Stake altered the landscape entirely, diminishing the role of traditional mining rigs and prompting a shift towards staking nodes. Understanding these subtleties is essential before investing in mining machinery, ensuring alignment with current technological and market realities.

Exchanges also play a subtle yet critical role in the mining economy. After heavy computational workloads yield new coins, miners rely on these platforms to convert cryptocurrency into fiat or other digital assets. Volatility in exchange rates can dramatically affect profitability. For instance, surges in BTC value can incentivize increased mining activity, while market downturns might lead to decreased network participation. Furthermore, some miners engage directly with decentralized exchanges to harness liquidity pools or participate in yield farming, strategies that add layers of complexity and opportunity.

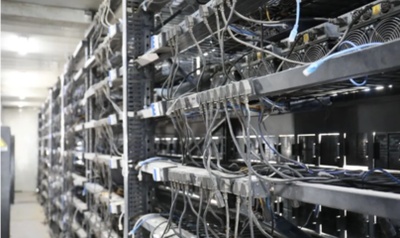

Moreover, the concept of mining farms expands the traditional notion of individual mining rigs. These large-scale operations integrate thousands of ASIC units, achieving economies of scale that individual miners cannot. Farms optimize placement, cooling, and energy sourcing—often leveraging renewable power to curb operational expenses and environmental impact. This scalability enables substantial contributions to network security but also raises questions about decentralization and potential market monopolization. Aspiring miners must decide whether to join such enterprises, invest remotely via cloud mining, or build modest setups tailored for niche altcoins.

The decision to buy a high-performance ASIC miner is thus far from trivial. Prospective miners must weigh the balance between upfront capital costs, anticipated returns, technological compatibility with target coins, and external variables like regulatory shifts or power market dynamics. Continual monitoring of blockchain developments, firmware updates, and community insights can illuminate paths to maximize efficiency and avoid obsolescence. Ultimately, while myths tend to exaggerate the ease or guaranteed gains of mining, informed strategies unlock real potential and foster sustainable engagement in the crypto revolution.

In conclusion, a high-performance ASIC miner can serve as a formidable tool within a well-crafted cryptocurrency mining strategy. Yet, peeling back the layers of hype reveals a complex interplay of hardware capabilities, network conditions, economic considerations, and coin-specific attributes. Whether your interest lies in mining Bitcoin, exploring Dogecoin’s merged mining benefits, or understanding the ramifications of Ethereum’s network upgrades, depth of knowledge remains your greatest asset. Mining is a marathon, not a sprint—invest wisely, stay adaptable, and embrace the intricate dance of digital currencies and their mining ecosystems.

This article shatters common misconceptions about high-performance ASIC miners, exploring hidden costs, efficiency trade-offs, and real-world profitability. It blends technical insights with practical advice, offering readers a nuanced perspective that challenges oversimplified buying decisions in the crypto mining market.