Essential Price Guide for High-Performance GPU Mining Rigs

In the dynamic universe of cryptocurrency mining, navigating the labyrinth of high-performance GPU mining rigs requires more than just a cursory glance at prices. The market is a complex landscape, shaped by fluctuating digital coin values, technological advancements, demand waves, and the relentless pace of innovation. For companies dedicated to selling and hosting mining machines, understanding the essential price guide for GPU rigs isn’t just beneficial — it’s imperative. These rigs are the backbone of mining operations for Ethereum (ETH), Dogecoin (DOG), and even Bitcoin (BTC) through alternative mining algorithms or hybrid setups that combine different mining types under one roof.

Mining rigs equipped with advanced GPUs have become the favored choice for many cryptocurrency miners. Unlike ASIC miners tailored predominantly for Bitcoin’s SHA-256 algorithm, GPU rigs offer versatility by supporting various algorithms, making them indispensable for mining ETH, DOG, and emerging altcoins. The pricing of these rigs intricately depends on several variables: the GPU model, number of cards, power efficiency, cooling solutions, and included accessories such as motherboards and power supplies. The newest Nvidia RTX and AMD Radeon series GPUs command premium prices, reflecting their superior hash rates and energy-saving features, which directly translate to mining performance and operational cost efficiency.

Hosting mining machines adds another layer of complexity — prices are influenced not just by hardware but by the hosting environment. Mining farms providing hosting must factor in electricity costs, cooling infrastructure, security, and maintenance. These operational expenses often justify the premium charged for hosting services, especially given the downtime sensitivity of mining rigs. Companies offering turnkey hosting solutions are thus in a unique position to bundle hardware sale prices with tailored hosting packages. This means miners can optimize returns while avoiding the risky and often expensive logistics of DIY installations — a critical consideration given the volatile nature of cryptocurrencies like Bitcoin and Dogecoin.

Speaking of volatility, the unpredictable nature of cryptocurrency markets continuously impacts mining rig pricing. When the value of Bitcoin (BTC) spikes, ASIC miners usually dominate the scene, but increasing BTC prices also indirectly boost demand for GPU mining rigs — as miners diversify into altcoins like Ethereum and Dogecoin to hedge risk and maximize profit potential. This demand ripple effect often inflates GPU rig prices temporarily. Conversely, when markets cool down or undergo regulatory scrutiny, hardware prices can plunge sharply, sometimes creating rare opportunities for bulk purchases.

Digging deeper into the nuance of individual cryptocurrencies: Ethereum’s transition to proof-of-stake has cast a long shadow over GPU mining rig valuations. As ETH miners anticipate the switch, many seek to offload or upgrade rigs, or pivot to coins like Dogecoin or other altcoins where GPU mining remains profitable. This shifting landscape disrupts pricing norms and creates a fluid secondary market. For mining farms and enterprises investing heavily in GPU rigs, keeping abreast of such protocol changes is pivotal to maintaining a competitive edge and ensuring investment resilience.

When assessing a mining rig’s price, consider operational efficiency, hash rate output, and potential ROI in various exchange ecosystems. Top-tier miners are designed to maximize hash rates per watt, lowering electricity costs — often the largest expenditure in mining operations. Exchanges play a silent but vital role here; higher transaction volumes, wider coin availability, and faster confirmations enhance miners’ turnover rates and, thus, profitability. Hosting providers often partner with exchanges to offer integrated dashboards that deliver real-time data and optimize payout scheduling, making mining more transparent and effective.

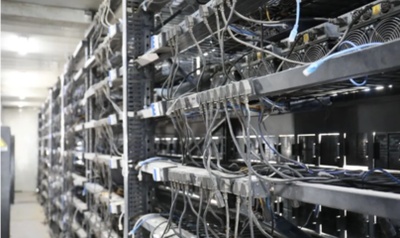

Finally, one cannot overlook the strategic advantage of mining farms equipped with large-scale GPU rigs. These mining farms leverage bulk hardware purchases to negotiate reduced unit prices and deliver hosted rigs with consistency and reliability unmatched by individual miners. The economies of scale also enable cutting-edge cooling technologies, sophisticated monitoring systems, and rapid response teams, all factors that influence the pricing benchmarks set by the market. For companies selling mining machines and hosting them, aligning pricing models with these realities is the hallmark of sustainable business.

In summary, the essential price guide for high-performance GPU mining rigs intersects technology, market dynamics, hosting logistics, and cryptocurrency trends. Whether mining Bitcoin’s legacy via ASIC rigs or embracing the versatile GPU rigs favored for Ethereum and Dogecoin, understanding the fluctuations and drivers behind rig pricing empowers miners and hosting companies alike. As the crypto mining landscape continually evolves, staying informed ensures that investments in mining machines and hosting yield not just operational security but robust profitability amidst the digital gold rush.

This guide offers a deep dive into the evolving costs of high-performance GPU mining rigs, exploring fluctuating market trends, component scarcity, and cost-efficiency strategies, making it indispensable for miners seeking optimized investment decisions in a volatile crypto landscape.