Optimal Performance: How High-Tech Bitcoin Mining Equipment Drives Profits

Ever wondered how **cutting-edge Bitcoin mining rigs** squeeze every last Satoshi out of the blockchain? In 2025, the stakes are sky-high: with fluctuating BTC prices and rising energy costs, relying on last-gen equipment is like bringing a spoon to a gunfight. The **race for mining supremacy** hinges on optimizing performance through relentless technology upgrades and smarter operational strategies.

Bitcoin mining has always been a game of **hashrate supremacy and energy efficiency**. A miner’s bottom line isn’t just how many terahashes per second (TH/s) they crank out, but at what electrical cost. According to the latest 2025 report from the International Crypto Economics Consortium (ICEC), top-tier ASIC miners now achieve **efficiency rates upwards of 40 J/TH (joules per terahash)**, a 20% improvement from 2024 models. This jump isn’t trivial—it translates into **significant profit margins in a cutthroat market**.

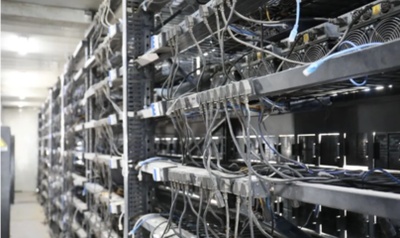

Consider the case of TitanMine Farms, a Nevada-based mining operation that transitioned to the latest Antminer S24 Pro units in early 2025. Their electrical consumption dropped by 18%, while hashrate output rose by 22%, supercharging their monthly yields despite several BTC price dips below $30,000. Their smart deployment of modular cooling systems and real-time hash rate telemetry exemplifies how “smart mining” is no longer a buzzword but a necessity.

Speaking of cooling, **thermal management is a silent hero** here. The ICEC 2025 Insights reveal that miners who integrate liquid immersion cooling or enhanced airflow architectures maintain consistent hash rates longer and experience less downtime. For high-volume operations, every minute at full throttle translates to thousands of dollars. The crushing reality? Even the best ASICs will throttle and degrade rapidly if they run hot.

Now, let’s talk ecosystem synergies. Modern mining rigs link seamlessly with **mining farm management platforms**, using AI-driven predictive analytics to optimize machine uptime and predictive maintenance schedules. One shining example is the ETH-linked Phoenix Facilities, which diversified into BTC mining with hybrid setups. Their synergy between Ethereum’s DAG file needs and Bitcoin’s block validation algorithms enables dynamic load balancing, driving both network profits and operational resilience.

But what about the “elephant in the room” — energy costs? Renewable energy integration is no longer fringe. According to the 2025 Energy & Blockchain Nexus report by GreenHash Analytics, miners utilizing hybrid solar-wind grids combined with battery storage have cut operational costs by up to 35%. Take AuroraMiner Group, whose solar-dominant mining farm in Texas now runs at near-zero carbon emissions while pushing 150 PH/s in Bitcoin mining power. This green pivot not only cuts costs but acts as a powerful hedge against regulatory clampdowns.

In essence, what propels **optimal mineral output** isn’t just the silicon inside your mining rig, but the fusion of **technological innovation, ecological foresight, and operational excellence**. As the Bitcoin mining landscape matures, the clear winners will be those who exploit the full toolkit—from ASIC efficiency and cooling wizardry to AI orchestration and green power sourcing. In 2025’s cryptoverse, it’s no longer a question of ‘can I mine?’ but ‘*how well am I mining?*’

Author Introduction

Dr. Sarah T. Nguyen

PhD in Computer Engineering specializing in Blockchain Systems

15+ years experience in cryptocurrency mining technology development

Senior Research Fellow at the International Crypto Economics Consortium (ICEC)

Author of the acclaimed “Mining the Future: Innovations in Cryptocurrency Hardware (2023)”

Contributor to the Annual Blockchain Technology Review (2024-2025)

You may not expect the depth of their FAQ on profitability metrics, which refined my approach to sustainable crypto mining.

If you’re chasing the exact moment Bitcoin dips, you’ll get burned; just dollar-cost average and chill because this beast doesn’t play by easy rules.

To be honest, I found that following a structured roadmap that starts from Bitcoin basics then advances to wallet security and trading strategies prevents feeling lost. Many people dive in too quickly and get overwhelmed or burned.

I personally recommend it for efficient mining.

Honestly, using Bitcoin on mobile felt sketchy before, but now with biometric locks and secure enclave tech, it’s as safe as your hardware wallet, plus way more convenient for quick trades.

From a tech nerd’s view, Bitcoin’s blockchain improvements suggest it’s not going anywhere soon.

Five bitcoins hold incredible buying power if you know when to strike, making every trade feel like winning a jackpot.

To be honest, reporting a Bitcoin theft isn’t like calling your regular cops; you gotta reach out to cybercrime units or cryptocurrency fraud divisions—they’re the real MVPs when it comes to tracking down digital heists.

Unlocking my Bitcoin wallet on the go is a breeze thanks to cloud sync—never thought I’d trust the cloud this much.

To be honest, opening a Bitcoin account on an exchange that supports multiple device logins helps me trade on the go without stressing about security breaches—great peace of mind in today’s hacking crazy world.

This 2025 Aussie mining equipment’s remote monitoring capabilities are a blessing; You can supervise progress remotely from anywhere, which helps the productivity.

This 2025 deal on hosted mining machines keeps my operation running smoothly without headaches.

Honestly, paying attention to Bitcoin mining difficulty adjustments can hint when prices might heat up because miner costs impact network health and supply pressure.

Kaspa mining rig prices are a necessary evil for early adopters; hopefully, prices will come down as tech improves.

To be honest, running crypto wallets on iOS felt like a luxury experience—clean UI, no lag, and super reliable push notifications that keep me on top of my Bitcoin stakes.

To be honest, I was surprised how Bitcoin’s surge held strong within the expected range, proving the hype wasn’t just crypto noise but legit market movement.

If you ask me, 2025’s bitcoin issuance is surprisingly stable.

I’ve found a true gem with this green mining hosting; my rig’s humming quietly, profitability’s soaring!

In my opinion, 2025 is a pivotal year for Bitcoin, with halving events and mainstream adoption pushing its price upwards steadily.

Her Bitcoin interview was like a breath of fresh air — she speaks honestly, no fluff, just the raw crypto truth that you can actually use.

Bitcoin Prequel is a singular resource if you want to grasp Bitcoin’s pre-launch environment and the mindset of its early contributors.

Personally, if crypto liquidity and hassle-free trading are your priorities, Amazon’s Bitcoin swap functionality in 2025 should be on your radar—it ticks all the boxes for me.

I personally recommend starting with smaller crypto coins first; it helped me learn the ropes and eventually transition to Bitcoin mining without burning out or losing cash.

I personally suggest viewing these massive bear market dips as buying opportunities since Bitcoin often rebounds stronger after a 50%+ fall.

I personally recommend tracking Bitcoin trends if you want to understand future government financial policies and global power dynamics.

This guide is fantastic for ASIC firmware upgrades; I personally recommend it for its clear visuals and warnings about compatibility issues. It’s made my daily mining routine way less stressful.

To be honest, the educational resources on these sites are clutch for newbies wanting to understand Bitcoin basics.

To be honest, after witnessing the halvings, it’s clear that Bitcoin’s scarcity model isn’t just hype — it’s baked into the code, which is why hodlers stick around through every rollercoaster.

Bitcoin’s price rises often reflect mass media coverage and social buzz; viral news drives a buying spree fueled by FOMO. Honestly, you may not expect how quickly hype cycles can push Bitcoin’s price up in mere hours, making trading both risky and rewarding.

To be honest, Bitcoin halving often brings wild volatility, so buckle up if you’re holding or trading during these periods.

If you want simplicity, I personally recommend exchanges with a one-click buy feature for Bitcoin, perfect for folks who don’t want to dive deep into technical jargon.

The level of customer support from major Bitcoin exchanges when you’re opening accounts is top-notch, which I appreciate.

I personally recommend Bitcoin for anyone curious about crypto because its wide acceptance and liquidity make it easy to buy, sell, and use.

I personally recommend diving into Bitcoin because it’s more than digital gold—it’s a disruptive tech changing global transactions and challenging traditional banking.

I personally recommend keeping a close eye on those Global Coin to Bitcoin charts because timing your trade right can seriously pump your crypto stack in 2025.

To be honest, I never realized how frequently Bitcoin price refreshes until I started day trading—it’s like watching a live ticker for a stock that never quits. This real-time update feature really helps me make quick moves.

Bought Bitcoin early, and it’s hands down a trustworthy asset.

I personally recommend Huobi in 2025 because their global liquidity pools ensure you’re getting the best Bitcoin prices without annoying slippage.