How to Optimize Your Mining ROI Through Smart Equipment Financing

Imagine pouring thousands into a shiny new **mining rig**, only to have your ROI crawl slower than a Bitcoin transaction during network congestion. **Why are some miners turning mining equipment financing into their secret weapon**? That’s the million-dollar question for many prospective and seasoned crypto miners alike in 2025.

**Mining rigs are no longer just hardware—they’re capital assets**, and how you finance them dramatically shifts your profitability curve. According to a recent report by the Cambridge Centre for Alternative Finance (2025), miners leveraging smart financing options see up to a 20% faster ROI turnover compared to those relying exclusively on upfront capital. This becomes a strategic chess game: choosing the right plan can be as crucial as picking the right hash algorithm.

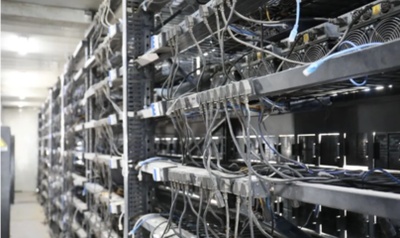

Understanding this starts with **unpacking the core financial mechanics** of mining equipment financing. Traditional outright purchases immobilize vast capital early, often leaving little room for scale or adaptation. Contrast this with innovative leasing, equipment-as-a-service (EaaS), and bundled hosting-financing models that allow operators to stay agile amid volatile market swings—especially with coins like BTC, ETH, and DOGE fluctuating unpredictably in 2025.

Case in point: a mid-sized mining farm in Texas recently adopted a hybrid financing model combining purchase loans with tailored hosting agreements. By capitalizing on flexible payment structures, they expanded rigs 30% faster, riding the ETH price surge earlier this year without exhausting liquidity.

**Diving deeper, what does ‘smart financing’ really entail?** It’s a cocktail of factors—interest rates, repayment terms, residual values, and even tax incentives—that must be tailored to a miner’s operational footprint and coin mix. For instance, Dogecoin enthusiasts often lean towards flexible plans to hedge against the meme coin’s notorious volatility, while BTC miners prioritize longevity and equipment depreciation strategies.

Beyond the contract fine print, **hosting services often bundle equipment financing with energy costs and maintenance**, creating a seamless, end-to-end mining experience. This curtails downtime—a critical metric that can shave weeks off your ROI timeline. In 2025, firms that integrated data-driven monitoring and predictive maintenance into their financing arrangements report 15% better uptime consistency.

Consider a Chinese ASIC miner network that integrated financing and hosting, supported by AI-powered operational analytics. This synergy empowered them to ramp up hash rates by 25% within four months post-implementation—an impressive leap in a sector growing increasingly competitive and margin-thin.

So, how should miners choose their weapon of finance? Industry veterans stress the importance of **aligning financing terms with coin market cycles**. For example, during bull runs, accelerated repayment options can solidify gains, whereas stable or bear phases favor extended terms to conserve capital. Flexibility and adaptability are the names of the game in 2025’s crypto mining arena.

Ultimately, the smartest mining operators don’t just chase hash power—they harness financial levers to optimize every joule of investment. In a world where **mining profitability is tethered to both technical horsepower and savvy capital strategies**, mastering equipment financing could be the defining factor between going bust and striking crypto gold.

Author Introduction

Andreas M. Klein is a seasoned cryptocurrency analyst and financial strategist specializing in mining economics and blockchain infrastructure investments.

He holds a Master’s degree in Financial Engineering from MIT and is a Certified Bitcoin Professional (CBP).

Andreas has penned numerous influential reports for the Cambridge Centre for Alternative Finance and frequently consults for top-tier mining farms worldwide.

His deep insights bridge the gap between cryptoeconomics and real-world operational tactics, empowering miners to maximize both technical and financial efficiency.

Mining Bitcoin isn’t just about speed; it’s about endurance. The calculation time is no joke, and sometimes I found myself recalibrating my rigs because the hash rate matters so much in cutting down the mining time.

You won’t regret this Ethereum mining machine; it’s packed with features that enhance profitability fast.

2025 hardware runs pretty hot; gotta have decent cooling up here in the Great White North!

Before ASIC specialization, Bitcoin mining was a hobby for tech geeks—they mined on laptops or desktops, trying to get that sweet early coin.

The solar Bitcoin miner prices are more affordable than ever in 2025!

The way Bitcoin converts to fiat currencies is pretty clever, combining satoshis with real-time market prices, so you get an accurate picture of your crypto assets’ value anytime. It totally changed how I monitor my portfolio.

During the outbreak, Bitcoin trading felt like surfing giant, unpredictable crypto waves.

You may not expect that some mobile wallets have hidden backup features. Discovering these saved me tons of headaches when I needed to find my Bitcoin last year.

I personally recommend traders use halving as a market signal to re-evaluate portfolios, as supply scarcity typically triggers big upward momentum in the following months.

To be honest, I didn’t think mobile Bitcoin price tracking was this good.

Russian miners are masters of overclocking; their rigs are pushed to the absolute limit. Efficiency is key!

You may not expect it, but professional traders use Bitcoin futures as part of their daily income strategy – it’s that powerful.

Cloud mining for Bitcoin in 2025 is a game-changer—less hassle, more profits, especially if you’re new to the blockchain scene.

Investing in Bitcoin mining rigs can yield great returns if done right.

You may not expect the impact of yuan fluctuations on Bitcoin’s cost, but it’s something crypto traders absolutely need to factor in.

Bitcoin’s market cap theory helped me get why everyone’s so obsessed with BTC supply limits. Honestly, it’s like digital gold on a whole new level—and that scarcity factor is what makes it so exciting to watch.

Bitcoin’s network effect keeps gaining momentum—more users mean more acceptance, a cycle that fuels its staying power.

Bitcoin’s rank reminds me of a chess grandmaster: strategic, dominant, and way ahead. If you want to up your crypto game, seeing Bitcoin beyond just a coin is a game changer.

Innosilicon T4 60T handles high loads without any overheating issues.

It blew my mind when I learned Bitcoin’s maximum supply is fixed at 21 million coins worldwide; it’s like owning a piece of a rare digital treasure instead of just some random tokens.

Wind mining system is worth every penny with energy credits.

I’m backing Aussie miners based on this 2025 analysis, pure hopium though.

You may not expect, but a simple formula to calculate Bitcoin gains transformed how I track crypto investments every day.

To be honest, the fact that roughly 20% of all Bitcoin is lost forever is a big deal that changes the supply-demand equilibrium in unpredictable ways.

Bitcoin maximalism’s a bit much, but respect the conviction.

Besides investing, learning about tax implications is crucial when dealing with cryptocurrencies and futures.

ersonally recommend this model because its durable build withstands constant use, ensuring long-term gains in the volatile crypto market of 2025.

Using Apple Pay with crypto apps speeds up Bitcoin purchases; it’s honestly one of the slickest payment methods I’ve tried so far.

If you want to sleep well at night owning Bitcoin, getting familiar with who regulates Bitcoin is a must, no joke.

The buzz around Bitcoin is real; today’s jump confirms it.

Crude oil reserves are measured in “proved” categories, influencing global markets and economic policies.

In mining hosting, electricity fees can surprise you if not monitored, but tools like real-time dashboards make it a breeze.

To be honest, using MACD crossovers on Bitcoin intraday charts saved me from multiple bad trades last year.

To be honest, sometimes simple line charts give cleaner insights than complicated graph setups cluttered with indicators in Bitcoin trading.

To be honest, Bitmain’s Hydro is a beast.

If you hold Bitcoin and want to buy more, stash some stablecoins to quickly jump on price dips – this tactic helped me catch bargains without delay.

I personally recommend diving into Bitcoin’s rank because it’s the gold standard. Its status sets the pace for the entire market, so grasping where it stands helps you make smarter investment calls.

User experience on Xiaoyang’s Bitcoin investment is top-notch; no lag, instant updates, and the community insights helped me pick the right moments to buy and sell.